The Covid-19 pandemic has disrupted our way of life in ways the world has never imagined or even predicted.

Many speculates that even if our scientists have found a way to keep the effect of coronavirus down to a manageable level, society could never ever go back to the way life used to be. It’s going to be a very different world after this.

While this crisis has brought people everywhere and here in the Philippines a lot of hardships and miseries, it has also brought us some welcomed change and at a certain extent – blessings.

Take for example the e-wallet like GCash, this little piece of digital innovation helped a lot of Filipinos get through with the quarantine period by empowering them with a simple tool to do cashless transactions whether for paying bills, sending money to loved ones or buying food, groceries and supplies online or offline.

It’s a wonderful consolation that the technology was already in place when the pandemic happened. A real blessing.

As with other new and remarkable innovations, GCash is still a work in progress and continues to effectively upgrade their system to give users seamless mobile and cashless transactions to as many partners possible.

For us e-wallet users the two most popular concerns are downtimes and security.

DOWNTIMES

Gone are the days of frequent system glitches, now downtimes are either caused only by system upgrades and maintenance activities.

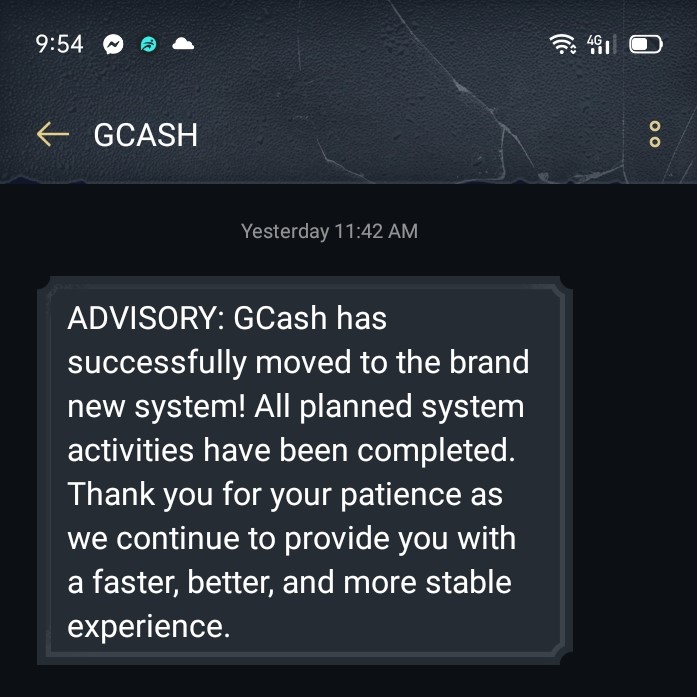

These downtimes are usually announced days and even a week before to ensure that few people will be affected by it. System upgrades and maintenance are scheduled at off-peak hours usually after midnight and is announced via a text message advisory under the account name GCASH. Once they text you again to inform you that everything’s back to normal.

SECURITY

While everything about GCash is made simple and easy, from registering an account to downloading the app and using its straightforward user interface – the opposite can be said when it comes to hacking into its system.

When you’re dealing with people’s money, security is of top priority!

GCash has made all the necessary measures to ensure that all your hard-earned money stored in your e-wallet are safe and secure. The only thing you have to worry about are the scammers.

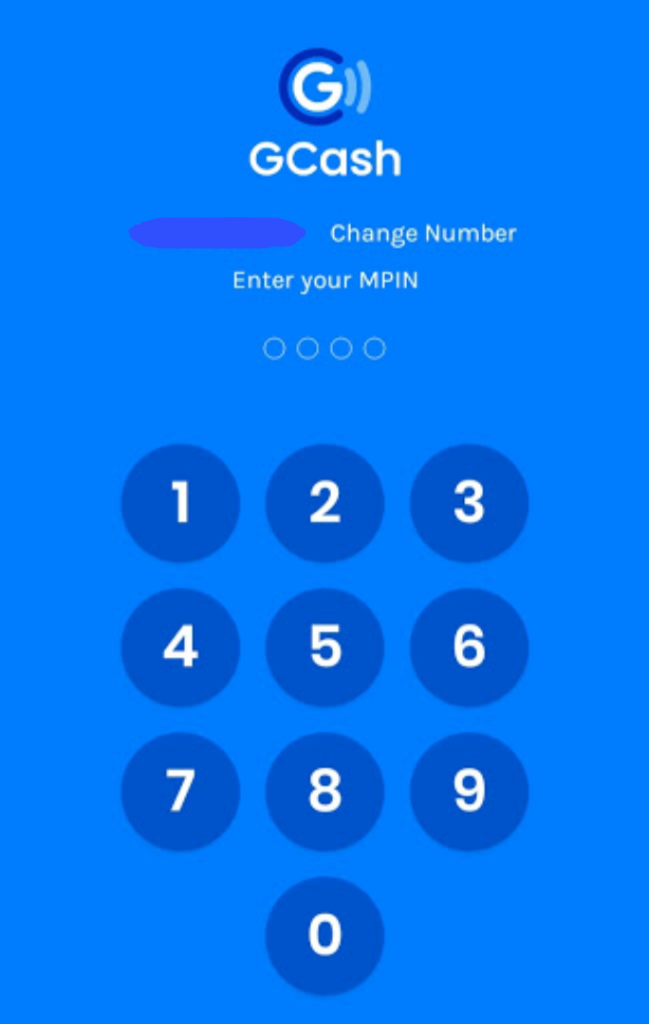

Just recently, the National Bureau of Investigation (NBI) arrested three (3) individuals in Quezon City for crimes done in violation of provisions stated in the Cybercrime Prevention Act, Identity Theft and Estafa. The perpetrators pretended to be either GCash, Grab, Lalamove, and Mr. Speedy employees. They would convince their victims that their accounts were compromised and offer to assist them in fixing their accounts. They will then ask for their victims’ personal details, including the account number, mobile personal identification number (MPIN), one-time password (OTP), authentication code, birthday, and e-mail addresses.

GCash after receiving complaints have conducted their own investigations and them submitted their findings to the authorities which then led to the arrest of the suspects.

To lessen the incidence of scamming, GCash has long since removed their social media helpdesk so as not to provide scammers with an opportunity to talk to unwitting client. For inquiries, you may just contact 2882 from your Globe number or use the in-app help and support features.

GCash also reminds users not to entertain unregistered numbers, click on unverified links and share their MPIN and OTPs to anyone. GCash will never ever ask for your MPIN, like how Facebook would not ask for your password during support requests.

Lastly, be aware that scammers are everywhere and just be vigilant because your e-wallet system provider can’t protect your money if you have given other people full access to it.

- G! LU is Poised to Become this Year’s Hottest Summer Movie - April 18, 2024

- Introducing the New OPPO Pad Neo – Big is Better! - April 17, 2024

- realme PH Announces the Arrival of realme 12 5G - April 16, 2024